WELCOME TO MARKET MASTERY

Learn How To Trade CryptocurrencIES.

SIGN UP

Login

MM3 Course

FIND US ON FACEBOOK

OUR APPROACH TO PROFITABLE TRADING

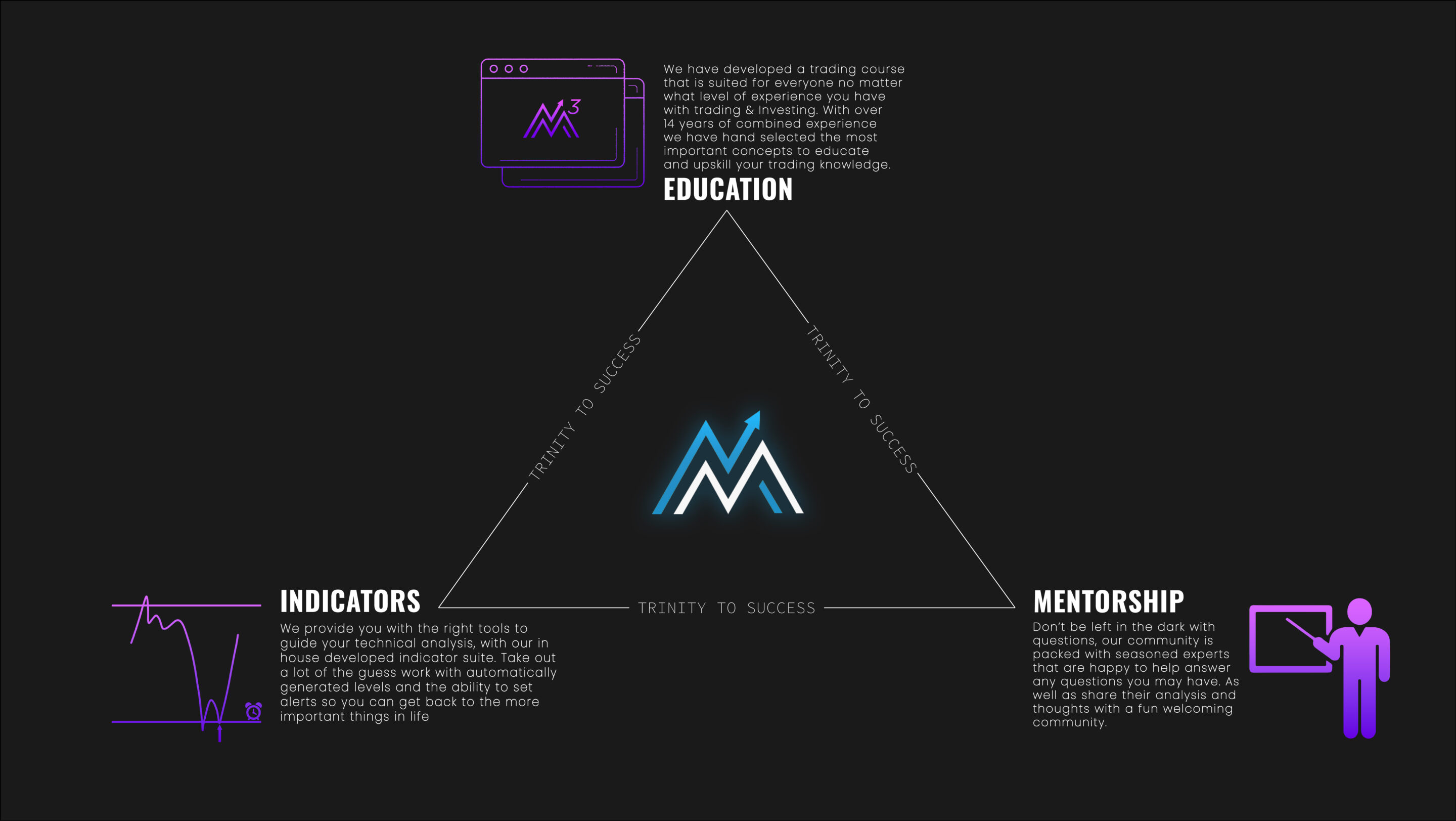

THE TRINITY TO SUCCESS

What is the Trinity To Success?

Since 2017, we have been actively involved in cryptocurrency trading, gaining deep insight into what works—and what doesn’t—in this dynamic market. Along the way, we’ve identified the most effective path to mastering trading: a structured, results-driven framework we call the Trinity to Success. This three-step approach is designed to take individuals from complete beginners to consistently profitable traders, by focusing on the essential elements that drive real, long-term success.

The Trinity to Success consists of:

Trinity Element 1: Education – MM3 Course

Our comprehensive MM3 Course is a self-paced educational program with 18 carefully structured lessons. It’s designed to support learners from beginner level through to advanced topics in market analysis, risk management, and macro context — helping individuals build the knowledge and confidence to approach the crypto space independently.

Trinity Element 2: Community Support

Members gain access to a collaborative learning space where they can share ideas, ask questions, and support one another in applying course concepts. The community also provides general discussions and insights about evolving market conditions — always with a focus on education, not advice.

Our custom-built indicator suite

We provide structured education on using our custom-built indicator suite, which includes proprietary software modifications designed to enhance how users visualise technical data. These tools can assist in identifying price levels and market zones, and offer the ability to set custom alerts for key chart conditions — helping users stay informed while maintaining flexibility in their daily routines.

Disclaimer: These testimonials reflect personal learning experiences from students of our cryptocurrency education programs. We do not provide financial product advice or services. Our content is general in nature and does not relate to regulated financial products. Individual results will vary and depend on each student’s effort, background, and decisions. Past outcomes do not guarantee future performance.

Our Team

Meet Our Experienced Team

Kyle Stagoll - daxx

Company Founder

Kris Carne - romps

Head Trader

Christopher Tyrrell - criddy

Member Success

Brendan Moss - Slimygreenmoss

Developer